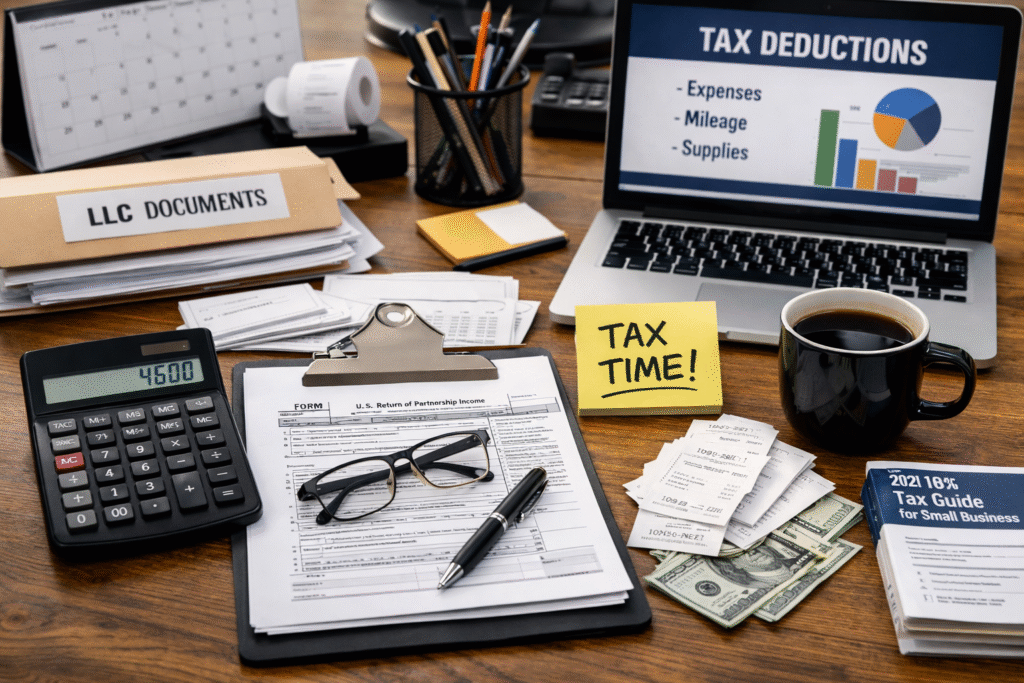

How to Prepare Your Cleaning LLC for Tax Season in California and Avoid Penalties

Running a cleaning LLC in California comes with great opportunities—but also serious tax responsibilities. Proper preparation for tax season is not optional; it is essential to protect your business, maintain compliance, and avoid costly penalties from the IRS and the State of California.

This guide is specifically designed for cleaning service LLCs in California, including residential, commercial, office, and specialized cleaning businesses. Whether you are a new LLC or an established company, these steps will help you stay organized, confident, and compliant.

Why Tax Preparation Is Critical for Cleaning LLCs

Cleaning businesses often handle:

- High transaction volumes

- Payroll for employees or contractors

- Vehicle and supply expenses

- Multiple clients and contracts

Because of this, tax errors are common—and penalties can add up quickly. Late filings, missing payments, or incorrect classifications can trigger fines, interest, and audits.

Proper preparation helps you:

- Avoid IRS and FTB penalties

- Maximize legitimate deductions

- Maintain good standing with the state

- Present clean records to banks, investors, and clients

Understand Your LLC’s Tax Obligations in California

Most cleaning LLCs in California must comply with both federal and state requirements.

Federal (IRS) Obligations

Depending on your LLC structure:

- Single-member LLC: Report income on Schedule C (Form 1040)

- Multi-member LLC: File Form 1065 (Partnership Return)

- LLC taxed as S-Corp: File Form 1120-S

In addition, you may be responsible for:

- Quarterly estimated tax payments

- Payroll tax filings if you have employees

California State Obligations

All California LLCs must:

- File Form 568 annually

- Pay the $800 minimum franchise tax (even if no profit is made)

- File and pay sales tax if applicable

- Submit payroll reports to the EDD if you have employees

Missing any of these can result in automatic penalties.

Keep Your Business Finances Separate

One of the most common mistakes cleaning business owners make is mixing personal and business finances.

To stay compliant:

- Use a dedicated business bank account

- Pay all business expenses with your LLC debit or credit card

- Deposit all client payments directly into the business account

This separation is critical for:

- Accurate bookkeeping

- Audit protection

- Preserving your LLC’s legal protection

Organize Key Financial Documents Early

Do not wait until the last minute. Throughout the year, keep organized records of:

- Bank and credit card statements

- Invoices issued to clients

- Receipts for supplies, equipment, and chemicals

- Vehicle-related expenses (fuel, maintenance, insurance)

- Payroll records and contractor payments (Forms W-2 and 1099)

- Rent or storage expenses for equipment

Well-organized documentation allows your tax preparer to work efficiently and reduces the risk of errors.

Track Deductions Common to Cleaning LLCs

Cleaning businesses often qualify for valuable deductions, including:

- Cleaning supplies and materials

- Equipment and tools

- Business vehicle mileage or actual expenses

- Insurance (general liability, workers’ compensation)

- Advertising and marketing

- Office expenses and software subscriptions

- Uniforms and protective gear

Only ordinary and necessary business expenses are deductible. Proper documentation is essential.

Stay Current on Payroll and Contractor Compliance

If your cleaning LLC has employees:

- Payroll taxes must be filed and paid on time

- Federal and state reports must be submitted regularly

- Workers’ compensation insurance is mandatory in California

If you work with independent contractors:

- Ensure they are properly classified

- Collect W-9 forms

- Issue Form 1099-NEC when required

Misclassification is one of the fastest ways to trigger penalties.

Make Estimated Tax Payments on Time

Many cleaning LLC owners are required to make quarterly estimated tax payments.

Failing to do so may result in:

- Underpayment penalties

- Interest charges

- Unexpected large tax bills

A professional can help you calculate accurate estimates based on your income and expenses.

Work With a Qualified Tax Professional

A tax professional who understands California LLCs and service-based businesses can:

- Ensure correct filings

- Identify legal tax-saving strategies

- Help you stay compliant year-round

- Represent you if questions arise from the IRS or state agencies

This is not an expense—it is a strategic investment.

Protect Your Cleaning LLC

By staying organized, understanding your obligations, and working with professionals, your California cleaning LLC can:

- Avoid penalties

- Reduce financial stress

- Focus on growth and new contracts

At M&H Cleaning Services, we believe that strong operations and financial discipline are key to long-term success in the cleaning industry.

If you are building or scaling a cleaning LLC in California, preparation is your strongest asset.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Always consult with a licensed tax professional regarding your specific situation.

No responses yet